In the dynamic world of investing, making well-informed decisions is key to achieving financial growth. The investment landscape, encompassing cryptocurrencies, stock indices, and innovative financial products like Fundo, presents varied opportunities and challenges. An analytical review of these options, focusing on their performance over the last two years, offers insights into their potential as part of a balanced investment portfolio.

Cryptocurrency Market: High Reward, High Risk

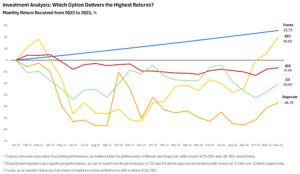

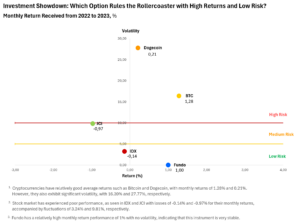

Cryptocurrencies have been a focal point for investors looking for rapid gains. Assets like Bitcoin (BTC), Ethereum (ETH), and Dogecoin have shown the capacity for substantial appreciation. However, their performance from 2022 to 2023 highlights a fundamental characteristic: volatility. With returns ranging from 20.03% for BTC to -36.76% for Dogecoin, these digital assets demonstrate a high-risk profile, largely influenced by market sentiment and external economic factors.

Stock Indices: Steady but Not Without Risk

Stock indices, such as JII and JCI, offer a different investment avenue. By pooling a variety of stocks, they tend to provide more stability than individual stocks. Yet, their performance can still be affected by overall market trends, as seen in the negative returns of IDX (-6.54%) and JCI (-20.65%). While they offer a degree of security, they are not entirely shielded from market downturns.

Fundo: A Rising Contender in Investment Options

Amidst these traditional and contemporary options, Fundo emerges as a noteworthy investment choice, particularly in the Asian financial markets. Fundo’s approach, integrating compounding methods in securities auctions, has yielded a commendable 25.72% return over the past two years. This performance is notable for its consistency and potential for higher yields compared to other investment vehicles.

Fundo operates within a regulated environment under the oversight of Indonesia’s Ministry of Finance and the Directorate General of State Assets. This regulatory aspect adds a layer of security and trustworthiness to its operations. The platform’s design caters not only to institutional investors but also to micro, small, and medium-sized enterprises (MSMEs), facilitating accessible capital through a controlled-risk auction system.

Conclusion: A Balanced Approach to Investment

The past two years have highlighted the importance of diversification in investment strategies. While cryptocurrencies offer high potential returns, their inherent volatility necessitates caution. Stock indices, despite their relative stability, are not immune to market fluctuations.

Fundo’s solid performance and regulatory framework position it as an attractive option for investors seeking steady growth with a managed risk profile. Its innovative approach to compound interest and its role in the Asian securities auction market make it a compelling choice for investors looking to diversify their portfolios. As with all investment decisions, potential investors should consider their individual risk tolerance and financial goals when evaluating Fundo and other investment opportunities.